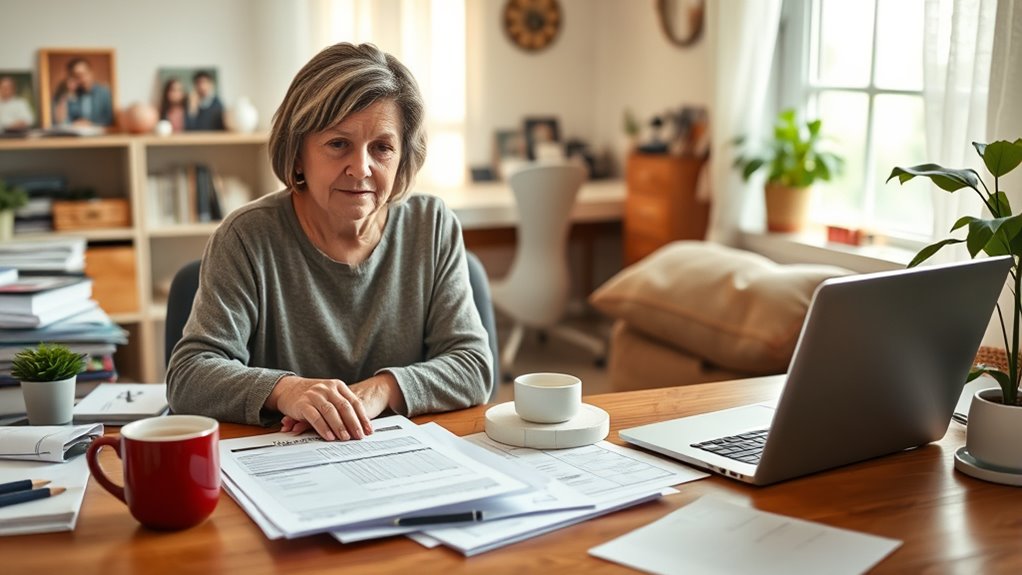

As a caregiver, you may qualify for tax credits like the Child and Dependent Care Credit, which can cover up to $6,000 for multiple dependents. You can also deduct medical expenses that exceed 7.5% of your Adjusted Gross Income, and use FSAs or HSAs for qualified healthcare costs. Proper documentation and understanding eligibility rules are key to maximizing benefits. If you want to learn more tips and strategies, keep exploring how to make the most of your tax benefits.

Key Takeaways

- The Child and Dependent Care Credit offers up to $6,000 for multiple dependents or $3,000 for one dependent.

- Medical expenses exceeding 7.5% of AGI are deductible if itemized on your tax return.

- Proper documentation of expenses, residency, and support is essential to claim credits and maximize deductions.

- Tax professionals can help navigate eligibility, optimize benefits, and ensure accurate filing for caregiver-related deductions.

- Keep detailed records of healthcare expenses, receipts, and support payments to support claims and ensure audit readiness.

Understanding the Types of Tax Credits Available for Caregivers

Understanding the types of tax credits available for caregivers can substantially reduce your tax burden. The Child and Dependent Care Credit helps offset caregiving expenses, offering up to $3,000 for one dependent or $6,000 for multiple dependents.

Caregivers can reduce taxes with credits like the Child and Dependent Care Credit, offering up to $6,000 for multiple dependents.

Additionally, the IRS provides the dependent care tax credit, which can be claimed using Form 2441, to support your caregiving costs. Incorporating mindfulness practices can alleviate the emotional stress often associated with caregiving responsibilities. Furthermore, many caregivers benefit from electric power generation techniques, which can help reduce energy costs while managing household expenses. It’s important for caregivers to be aware of key steps in the divorce process, especially if they are navigating personal challenges while providing care. Regularly engaging in self-care routines can greatly enhance emotional well-being, much like how eye patches are used to refresh the appearance of tired eyes.

Medical expenses paid for dependents, including elderly parents, may qualify for deductions if they exceed 7.5% of your adjusted gross income.

Proper support records, receipts, and documentation of qualified medical expenses are essential to claim these tax credits and deductions accurately. Understanding these options helps maximize your benefits and ensures compliance with IRS requirements. Moreover, state taxes on IRA withdrawals can influence overall financial planning for caregivers managing long-term expenses.

Eligibility Criteria and Documentation Needed for Caregiver Tax Benefits

To qualify for caregiver tax benefits, your dependents must meet specific criteria, including having a gross income of $4,400 or less for the year and living with you for at least half the year. Glycolic acid can help in controlling oil production, preventing acne formation, which can be beneficial for caregivers managing their own skincare needs amidst their responsibilities. Fresh lemon juice, for instance, should be kept properly to avoid spoilage, as signs of spoilage can lead to unnecessary waste and health concerns. Additionally, data analytics can provide valuable insights into caregiving expenses, helping you manage finances effectively. Implementing mindful decluttering strategies can also aid caregivers in creating a more organized and efficient home environment.

Proper documentation is vital to establish eligibility for tax credits and deductions. Keep detailed records of medical expenses, support payments, and residence verification to substantiate your claims. These documents help verify the dependent’s relationship and residency status, which are essential for claiming caregiver benefits. You’ll need IRS forms like Form 2441 for the Child and Dependent Care Credit and Schedule 8812 for the Child Tax Credit.

Maintaining organized documentation ensures accurate calculations, supports your claims during audits, and maximizes your eligibility for tax deductions and credits related to caregiving. Additionally, increased smartphone usage among seniors can facilitate communication about caregiving needs and expenses.

How to Maximize Medical Expense Deductions and Use Flexible Spending Accounts

Maximizing your medical expense deductions and making the most of Flexible Spending Accounts (FSAs) or Health Savings Accounts (HSAs) can substantially reduce your tax burden when caring for dependents. To do this, track all healthcare expenses that qualify as medical expense deductions, such as prescriptions, dental care, hearing aids, and in-home care. Predictive analytics can also help you anticipate future medical costs, allowing for better financial planning. Additionally, understanding how color accuracy impacts overall image quality can help you choose the right equipment for creating a comfortable caregiving environment. It’s also important to consider organic juices as a nutritious way to support health for both caregivers and dependents. Regularly monitoring your production quantity variance can also help you better manage caregiving expenses.

These costs are deductible if they exceed 7.5% of your AGI and you itemize deductions. Use FSAs and HSAs to pay for qualified medical expenses with pre-tax dollars, lowering your taxable income. Be aware that payments from these accounts can’t be claimed again as deductions, so plan accordingly.

Keep detailed documentation and receipts to maximize tax benefits and ensure proper reporting, optimizing your overall tax savings for healthcare expenses. Additionally, consider using cozy textiles in your caregiving environment to enhance comfort and well-being for both you and your dependents.

Step-by-Step Guide to Claiming a Parent or Dependent as a Tax Deduction

Claiming a parent or dependent as a tax deduction requires careful attention to IRS criteria and proper documentation. First, verify that your dependent qualifies as a relative, such as a parent or grandparent, and meets income limits—gross income under $4,700 in 2023.

Gather proof of residency, medical expenses, and support payments to support your claim. You must pay over 50% of their expenses and ensure they’re a U.S. citizen, resident alien, or national. Additionally, understanding financial affidavits can help ensure your documentation accurately reflects your support for the dependent.

Complete the appropriate IRS forms, like Schedule 8812 for the Child Tax Credit or Form 2441 for Child and Dependent Care Credit, carefully double-checking all calculations and supporting documentation. This verification process guarantees your claim is accurate and maximizes your eligible tax deduction for supporting your qualifying relative. Additionally, understanding filial responsibility laws can help you navigate any potential financial obligations related to caregiving.

Common Pitfalls and Tips for Accurate and Effective Tax Filing as a Caregiver

Managing the complexities of tax filing as a caregiver can be challenging, especially when it comes to avoiding common mistakes that could reduce your benefits or trigger audits.

Handling caregiver tax filings carefully helps prevent errors that could reduce benefits or cause audits.

To ensure claim accuracy, carefully review IRS guidelines for deductions, credits, and qualified dependents. Keep detailed records and receipts for medical expenses, caregiving costs, and support payments to substantiate your claims.

Double-check calculations of caregiver tax credits and other deductions using IRS instructions or tax software. Be cautious of common mistakes, like claiming non-qualifying relatives or misapplying income limits.

Consulting a tax professional can help navigate complex situations and maximize benefits. Staying vigilant about recordkeeping and understanding the rules will help you file accurately and confidently, avoiding pitfalls that could jeopardize your rightful credits and deductions. Additionally, understanding alimony types may provide insight into financial obligations that impact your overall tax situation.

Frequently Asked Questions

Is There a Federal Tax Credit for Caregivers?

You’re wondering if there’s a federal tax credit for caregivers. While there’s no specific “caregiver credit,” you may qualify for the Child and Dependent Care Credit if you’re supporting dependents like children under 13 or disabled relatives.

This credit covers a percentage of your qualifying expenses, with limits. Make sure to keep detailed records and check IRS guidelines or consult a tax professional to confirm your eligibility and maximize your benefits.

Can I Deduct Caregiver Expenses on My Taxes?

Did you know nearly 43 million caregivers in the U.S. provide unpaid care?

You may be able to deduct some of your caregiving expenses if they’re for a qualifying dependent and exceed 7.5% of your adjusted gross income.

Costs like in-home care, medical devices, and transportation to medical appointments might be deductible.

Keep track of these expenses, as they could lower your tax bill and provide valuable relief.

What Is the $5000 Caregiver Tax Credit?

The $5,000 caregiver tax credit is a federal benefit that helps you reduce your tax bill if you provide substantial care to a qualifying dependent.

You can claim up to $5,000 as a nonrefundable credit, meaning it lowers your taxes dollar-for-dollar.

To qualify, you need to meet specific criteria related to your dependent’s support, residency, and relationship.

Make sure to keep good records to support your claim.

What Are the IRS Rules for Paying Caregivers?

Think of paying your caregiver as planting a well-structured garden; every payment must be carefully documented to flourish. You should pay through traceable methods like checks or electronic transfers, ensuring the IRS can follow your financial trail.

Make sure your caregiver is qualified, and keep receipts or invoices. Following these rules keeps your financial garden thriving, preventing weeds of disallowed deductions from creeping in and ensuring your expenses are properly recognized.

Conclusion

So, as a caregiver, you’ve got plenty of tax perks waiting—if only you can navigate the maze of credits and deductions. Ironically, the hardest part might be just figuring out what you qualify for while juggling endless paperwork. But hey, at least you’ll have some extra money to spend on that long-overdue vacation… or maybe just more paperwork. Either way, you’re now officially a tax-saving pro—almost.